I am writing to provide you with some perspective on the market’s recent reaction to the coronavirus outbreak and what that might mean for your investments.

What is happening in the markets?

The spread of the coronavirus disease (COVID-19) and the recent growth in new cases outside of China have prompted a sharp market correction in global stock markets. Even assets typically seen as safe havens, such as gold, have gone down in value. The outbreak has already had a significant effect on China, the world’s second-largest economy with a key role in the global supply chain and a consumer of foreign goods. With the virus continuing to spread, markets are continuing to react to the outbreak’s expanding potential impact on the global economy.

What should we expect to happen next?

In the short to medium term, we can expect weaker economic growth and a decrease in corporate earnings. It will take time for China to resume production and for the disruption to global supply chains to be repaired. The effect on the global economy could be worsened if the number of cases outside China continues to grow. However, other factors are supporting the markets. China is stimulating its economy with monetary and fiscal policy, and both the U.S. Federal Reserve and Bank of Canada have stepped in with a 0.5 percentage point cut to interest rates. It is likely that other governments and central banks will respond similarly, helping to stabilize the economy and the markets while this disruption runs its course.

What should I do?

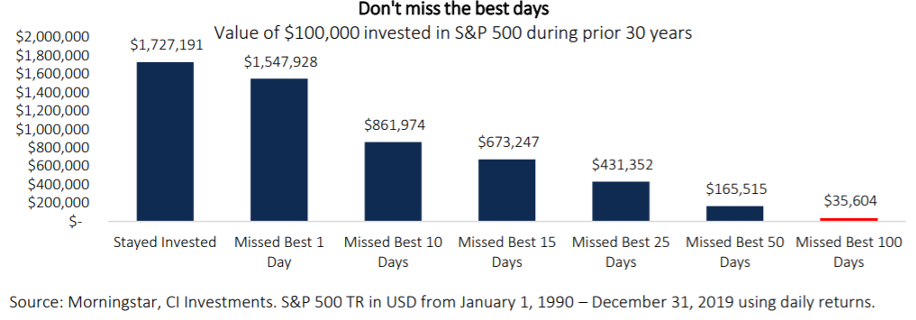

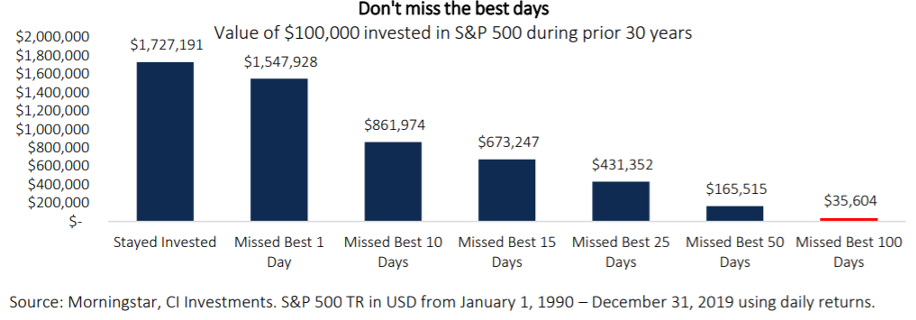

Stock market downturns are a natural part of the investment cycle and over the long term, investors who stay invested – rather than trying to time the markets – have been rewarded. This market decline may also represent an opportunity to buy quality companies at attractive prices for those with a long time horizon and enough conviction to follow-through with making an investment during this volatile time. I’ve included the chart below to demonstrate the risk of not being invested and missing out on the stock market’s best days, which often come after large declines like we have recently seen.

My advice is to stick with your existing long-term investment plan, which takes into account stock market volatility. Your plan was carefully constructed to reflect your personal objectives and investment time horizon.

Through our past interactions we have always done our best to partner up and ensure that the investments that you currently own are suitable for you. That has always been our goal. The investments that were suitable for you a month ago, (before this COVID19 virus became the pressing issue that it is today) will likely still be suitable for you after this crisis dies down. My responsibility is to help you navigate through times like these so as to ensure that you are comfortable with the investments that you own. If your investment goals and time horizon have not changed, than chances are your investments should not change. If, for whatever reason, your goals or time horizon have changed, then we should discuss that.

If you have any questions about your investments, please contact me at 204-293-4305 or email me @ aaleshka@sterlingmutuals.com. If you would like to arrange a meeting with me, we can book an in-person visit or a “Zoom Meeting” and meet remotely. If you would prefer a zoom meeting, please click on my personal link: https://zoom.us/j/5860695705

I know that many of you have reached out to me already and I appreciate you making a proactive effort to get in touch with me even before I can get in touch with you. I have time for everybody’s questions so feel free to contact me anytime. I am here to help. The ways to get in touch are mentioned above.

Lastly, I am not an epidemiologist or virologist, but please stay vigilant and continue to practice good hygiene during this Spring, Summer and beyond. Be sure to wash your hands throughout the day and practice some social distancing where and when necessary for the next while. If you are sick, stay home. Use common sense throughout this period of volatility. It’s the smart thing to do!