Life can throw unexpected events your way that can hit you in the wallet. Whether it’s falling ill, getting laid off, or facing hefty repair bills for your car or home, these situations can strain your finances. To stay ahead and avoid falling into debt, it’s a good idea to have an emergency fund. This is cash you set aside specifically to handle unforeseen expenses, so you’re not left scrambling for money when the unexpected happens.

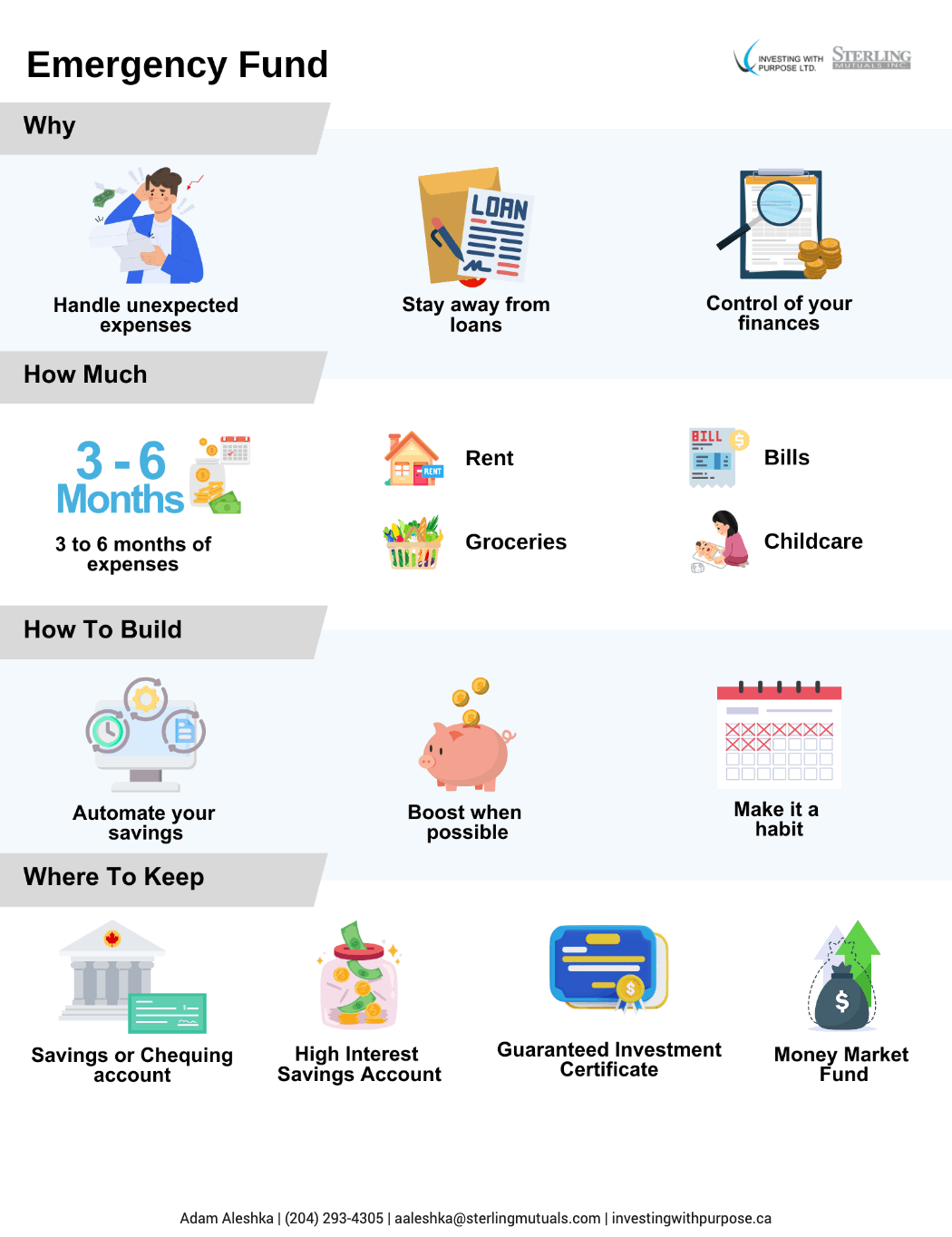

Why Emergency Funds Matter

An emergency fund is like an insurance policy for unexpected expenses that everyone can benefit from. It’s a stash of money specifically saved to cover daily living costs during emergencies that catch you off guard, such as:

-

Sudden car repairs

-

Vet visits

-

Losing your job

-

Sudden home repairs

-

Medical emergencies

Creating an emergency fund helps you to:

-

Deal with surprise costs without going into debt

-

Stay away from expensive loans like payday loans or credit card cash advances

-

Keep control of your finances

-

Feel less worried about unexpected expenses.

An emergency fund offers peace of mind during life’s surprises, preventing debt by covering costs without needing to use up savings or retirement funds, which could result in extra fees.

How much do you need?

The amount you should save depends on your financial situation, like how much you earn, what you spend each month, and if you have any dependents. A good rule is to have enough money to cover three to six months of necessary expenses, like rent, groceries, bills, and childcare.

How to Build Your Emergency Fund

Building an emergency fund to cover three to six months of essential living expenses might feel overwhelming, but the key is to start saving gradually. Even putting away a small amount regularly can add up significantly over time.

Here are some ways to build up your emergency fund:

-

Automate your savings: Pick how much money you want to save, when you want to save it, and how often. Then, arrange for the money to be automatically moved from your regular account to your savings account. You can set up this automatic transfer to happen on your payday. That means the money you’ve chosen to save will be moved as soon as your paycheque is put into your account.

-

Take advantage of opportunities to boost your emergency fund whenever you can. This might happen when you get extra money, like a tax refund, a pay raise at work, or when you sell things such as a car. Even receiving money as a gift or getting a bonus from your job can help. Additionally, when you finish paying off a loan, consider putting the money you used for payments into your emergency fund instead. Since you’re already used to budgeting for those payments, it’s an easy way to increase your savings without much extra effort.

-

Make it a habit: Make saving a regular part of your routine by incorporating it into your daily habits. Here are some simple tips to help you get started: drop any loose change into a container whenever you come home, set up a savings, mark your saving dates in advance on your calendar, and use sticky notes on your fridge to remind yourself to save regularly. These small actions can make a big difference in building your savings over time.

Where to keep your emergency fund?

Given that emergencies can occur unexpectedly, having quick access to your funds is important. Although a regular chequing account may offer immediate access to your money, it’s best to keep your emergency fund separate from your regular account. This prevents accidental spending on non-emergencies. Look for an account that:

-

Is distinct from your regular spending account

-

Has minimal or no transaction fees

-

Permits penalty-free withdrawals

-

Earns interest on your savings

Consider exploring “cash equivalents” as an option to invest your money. They’re a bit like cash but can also help your money grow with interest. They’re safe and easy to get your money from. But before you decide, make sure you understand how and when you can take your money out and if there are any extra fees or charges. Examples of cash equivalents include:

-

Savings accounts

-

Chequing accounts

-

High-interest rate savings accounts (HISA)

-

Guaranteed Investment Certificates (GIC)

-

Money market funds

Having an emergency fund can be a lifeline during tough financial times, preventing you from falling into debt. While there’s no fixed amount you should stash away, assessing your financial situation can guide you in determining your ideal emergency fund size. If you need assistance in planning your emergency fund, don’t hesitate to reach out to us for personalized guidance and support.